Battery electric vehicles (BEVs) have made remarkable strides in the passenger car market, establishing themselves as a standard drivetrain option. This success is now extending beyond cars, influencing various vehicle segments, including vans, trucks, buses, 2-wheelers, and more. However, fuel cell electric vehicles (FCEVs) face considerable challenges in achieving widespread adoption, despite having notable supporters. What are the primary obstacles, and in what areas can FCEVs still contribute to a zero-emission transport network?

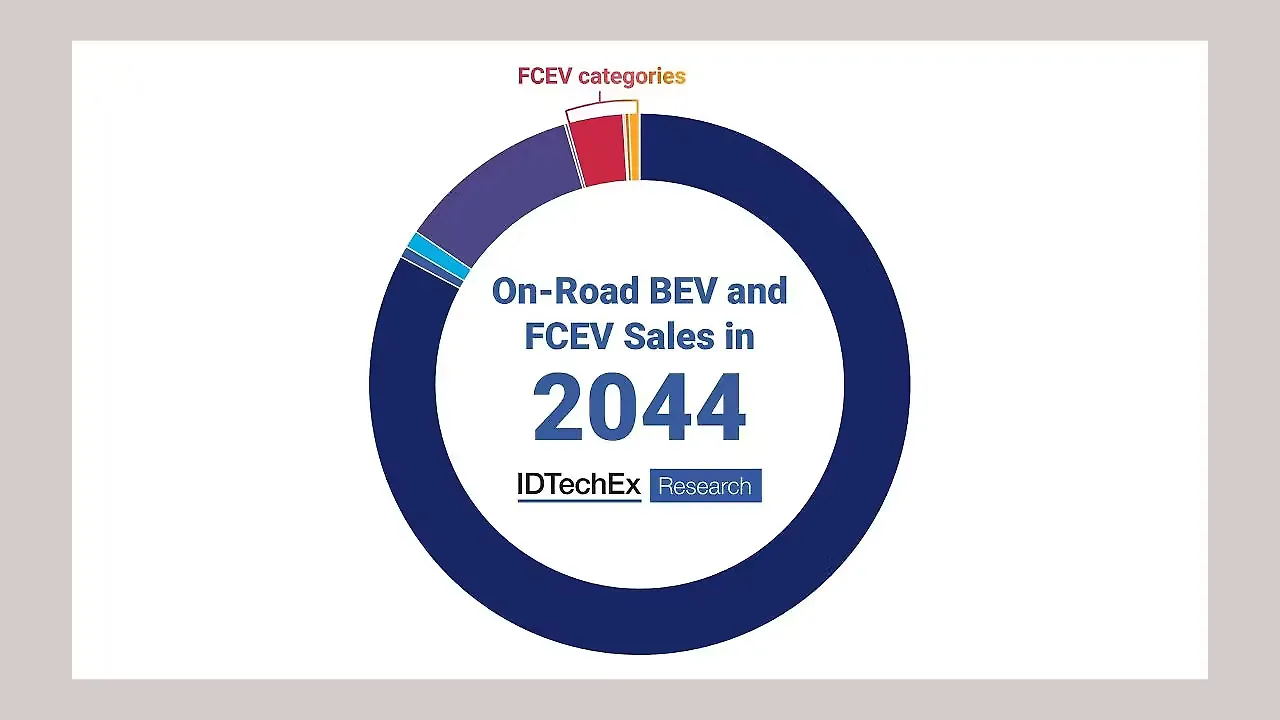

IDTechEx's comprehensive analysis, 'Fuel Cell Electric Vehicles 2024-2044,' unveils a nuanced perspective on the evolving role of Fuel Cell Electric Vehicles (FCEVs) within the zero-emission transport paradigm. This report delves into the historical and current adoption of FCEVs, identifying barriers, drivers, and strategic forecasts across various vehicle segments, providing a roadmap for the industry's trajectory.

Passenger Cars

Despite Battery Electric Vehicles (BEVs) dominating the passenger car market, FCEVs struggle to secure significant adoption. In 2022, FCEVs represented a mere 0.2% of zero-emission car sales. Major obstacles include the scarcity of hydrogen refuelling infrastructure, high hydrogen costs, and the upfront expense of FCEVs. IDTechEx's cost analysis in California reveals the formidable challenge FCEVs face in cost-per-mile compared to BEVs. Although the research organisation anticipates growth in FCEV sales with increased hydrogen availability, it expects FCEVs to remain a marginal player in the zero-emission passenger car market.

Light Commercial Vehicles (LCVs)

The challenges facing FCEVs in the LCV segment mirror those of passenger cars. With Total Cost of Ownership (TCO) serving as the primary driver for LCVs, the report posits that typical BEV ranges sufficiently meet most LCV drive cycles, negating the need for FCEVs. Growth opportunities for Fuel Cell LCVs seem confined to regions with robust government support for hydrogen economies and specific longer-range routes, emphasizing a limited near-term market.

Buses

Commercially available FCEV buses, often part of pilot programmes, grapple with higher upfront costs compared to their BEV counterparts. While FCEV buses show promise in certain scenarios, cost competitiveness with BEV buses remains uncertain due to the challenge of producing sufficient 'Green' hydrogen. IDTechEx anticipates a low penetration of FCEV city buses, primarily in countries heavily investing in hydrogen infrastructure. The potential for FCEVs may find a niche in intercity coach markets.

Trucks

The heavy-duty truck market stands out as a potential stronghold for FCEVs. Limitations imposed by large batteries on BEV trucks' range and loading capacity are countered by FCEVs' ability to utilise hydrogen for longer distances. Despite concerns about the cost and availability of low-cost green hydrogen, IDTechEx sees a substantial opportunity for FCEVs in the zero-emission truck market. While BEVs are predicted to dominate, the company forecasts a noteworthy 19% share for FCEVs in the zero-emission heavy-duty truck market by 2044.

Conclusion

The report foresees a nuanced future for FCEVs, emphasising their potential in specific market niches while acknowledging the formidable challenges they face in achieving widespread adoption across various on-road transport segments in the zero-emission landscape.

Courtesy: IDTechEx.

Also Read:

Hyundai, Kia Join Gore For Breakthrough In H2 Fuel Cell Technology