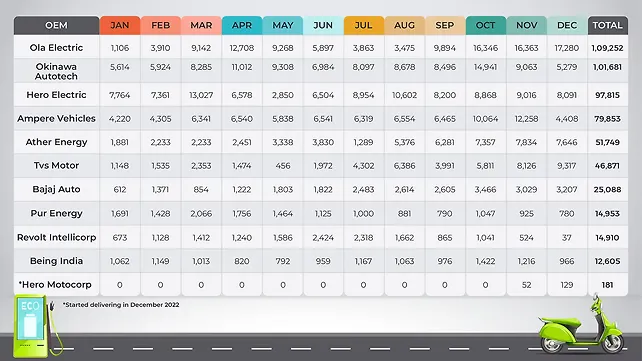

When it comes to electric two-wheeler (E2W) retails in 2022, it was a year that belonged to the start-ups. Numbers sourced from Vahan Portal show that Ola Electric led the way with 109,252 E2Ws sold in 2022, followed by Okinawa Autotech with 101,681 units and Hero Electric with 97,815 units.

However, major shifts might take place in these rankings by the end of 2023, feels Puneet Gupta, Director, IHSMarkit.

“Traditional motorcycle and scooter makers such as Bajaj Auto and TVS Motor are focusing on setting up local supply chains for manufacturing E2Ws. They will focus on end-consumer sales once this is done and that is when they will get aggressive on sales,” he told Mobility Outlook.

Bhavish Aggarwal, Founder and CEO, Ola Electric, believes that the next year is poised to open the floodgates for electric vehicles in the country.

The Top Five E2W Brands

Ola Electric, Okinawa, Hero Electric, Ampere, and Ather Energy, were the top-selling E2W brands of 2022. Interestingly, none of India's traditional OEMs could manage to find a place among the top five.

TVS Motor, on the sixth rank in the top ten selling E2Ws list, has done the majority of its end-consumer sales during the last five months of 2022, with its best performance coming in December 2022 at 9,317 units. On the other hand, Bajaj Auto has had an average year with sales of 25,088 E2Ws.

Notably, similar to TVS and Bajaj, Ola Electric and Hero MotoCorp-backed Ather Energy has also shown one of their best performances of 2022 in December. Saurav Kumar, Managing Director, Protiviti Member Firm for India, had earlier pointed towards Ola Electric as a brand that has created a lot of buzz with its E2W offering, its sustainability commitments, and ambitious plans.

“Being a shared mobility leader in India, Ola understands the dynamics of the country’s mobility market. The company is using the same knowledge in its electric scooter business,” he said.

Ather Energy might be able to catch up with the top three E2W OEMs in 2023 as there are rumours of the start-up working on launching a sub INR 100,000 electric scooter in India. Subhabrata Sengupta, Executive Director, Avalon Consulting, had earlier explained that not a lot of end-consumers in the country want to spend over INR 100,000 on an electric scooter.

“Ola, Okinawa, & Hero Electric have sub INR 100,000 electric scooters in their portfolio,” he said.

Ampere And TVS Motors Surprise Many

The biggest surprise in the E2W retail space was delivered by Ampere By Greaves. It retailed 79,853 E2Ws during 2022 with November 2022 as its best month (12,258 units). The OEM's performance also dipped in December as it sold only 4,408 units.

“Ampere, unlike most other E2W OEMs, is targetting the tier-3 & tier-4 markets,” said an analyst working with an Ampere competing OEM. The individual continued that Ampere has set up a good dealer channel to facilitate sales in geographies around the rural towns in the country. According to him, the same will help Ampere in its expansion phase through 2023 and 2024.

Boiling down the performance of Ampere on a Quarter-on-Quarter basis, it becomes evidently clear that the OEM grew 27.26% during Q1FY23 (over Q4FY22), 2.21% during Q2FY23, and 38.23% QoQ during Q3FY23.

TVS Motor posted the highest QoQ growth at 276.19% during Q2FY23, while Ola Electric posted 190.09% QoQ growth during Q3FY23. Since July 2022, TVS Motors has been retailing electric scooters north of the 4,000 mark in India (barring September).

Not to forget that the country’s largest OEM Hero MotoCorp has started its E2W journey in India recently, and a total of 129 Hero MotoCorp E2Ws have been registered in India during December 2022. The OEM had recently announced about it commencing deliveries in India.

Gupta is of the view that the entry of Hero MotoCorp will shake the E2W market in India. “Given the trust it follows in the Indian market, and its market reach, the OEM will always have an upper hand in terms of E2W sales,” he said.

SMEV Suspects Foul Play

If not for the Government of India's scanner against Hero Electric and Okinawa, either of the two OEMs could have occupied the number one podium in terms of E2W sales in India in 2022. The former had retailed over 10,600 E2Ws in August 2022 and over 13,000 in March 2022. However, its end-consumer sales fell to 8,091 units in December 2022.

Similarly, Okinawa had retailed over 14,000 E2Ws in October 2022, but its sales shrank to 5,279 units in December 2022. Kumar explained how the Government's scanner has led to a price increase of 30-50% for Okinawa and Hero Electric E2Ws.

He said, “The price hike has ended up hitting sales for these OEMs.”

Meanwhile, the Society Of Manufacturers Of Electric Vehicles (SMEV) has written to the respective Government authorities in India (including the Department of Heavy Industries) alleging that fake email accounts are dictating EV policies to DHI. It has been also alleged that the fake email accounts are especially targetting 'start-ups in the E2Wheeler sector', and the same has resulted in a backlog of INR 1,100 crore in subsidies (FAME II and others) for these start-ups.

A petition sent by the SMEV to the Parliamentary panel of India read, “We are asking the Department to take action – to take back control of policy as well as proactively reimburse the start-ups of the damage they have caused them. But that is not all. Question is, if the department has taken action against OEMs based on his (Fake Email Address) allegations, what about his allegations of collusion within the department?”

Mobility Outlook tried to speak to DHI for a comment on the allegations leveled up by the SMEV but was not able to attract any responses from the same till the time this story was filed!

Sohinder Gill, CEO, Hero Electric, in a recent statement issued by the OEM said, “One such hurdle thrown our way in 2022 was the carpet bombing of a tirade of malicious carefully curated incessant campaigns to bring down the top E2W players including us, carpet bombing all the ministries and the media. These faceless Swiss-based mails slowly spread their net to 12 EV players, leaving only the legacy players untouched. These mischievous elements were able to pull down our volumes to half of what had been planned but could not deprive us of the market leadership position.”

Notably, the Centre has disbursed INR 3,311 crore as incentives to end consumers buying electric vehicles under Phase II of the Faster Adoption and Manufacturing of Electric Vehicles (FAME II India) scheme. From INR 500 crore in 2019-2020, the budget for FAME II has increased to INR 1128.45 crore in 2022-23. It is also to be mentioned here that FAME II was launched with an outlay of INR 10,000 crore, and among other vehicle categories, it aims to support one million electric two-wheelers.

Gupta is of the view that the drying up of FAME II subsidies (in two years from now) will not leave an impact of the E2W sales, as OEMs by that time will have built economies of scale, and will be able to offer E2Ws at attractive costs without needing subsidies from the Government of India.

Also Read