FY21 is one year the auto industry would like to forget in a hurry – a year full of challenges, fear, anxiety and of course, hopelessness. However, at a time when all other industries were grappling under the COVID-19-induced impact, the Indian auto industry showed resilience and agility to bounce back. The industry did not have just one task in hand, but had to fight through multiple challenges to stand back again.

The Indian auto industry reported seven-year low figures in FY21. According to data released by SIAM, the overall industry fell 13.6% to 18,615,588 units last fiscal.

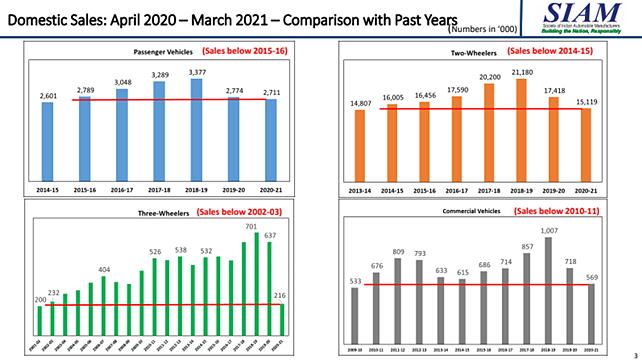

In what is a serious contraction of overall sales, the commercial vehicle segment has been pushed back by 10 years, two-wheelers and passenger vehicles slid back by six and five years respectively, while the three-wheeler segment has been pushed back by a staggering 18 years.

The outbreak of COVID-19 towards the end of the previous fiscal, FY20, had a major impact on sales in FY21. The nationwide lockdown imposed by the government led to zero sales in April last year, and negligible overall sales in Q1 FY21.

But is it really the virus that jolted the industry or there were other factors that played their role in pulling the industry down?

Multiple Impact Factors

Industry insiders pointed out that apart from COVID-19, there have been structural, tactical and macro-economic factors that impacted all the segments differently. The Indian automotive industry is going through a transformation right now as few segments are feeling the impact of electrification, while few saw the impact of rising cost due to technology upgrade.

The slowdown in the auto industry was evident since FY20, when the industry fell 18% to close at 21,548,494 units as compared to 26,266,179 units in FY19. While COVID-19 had minimal impact on FY20 sales, we must bear in mind that FY20 was a year when automakers were preparing for the transition to BS-6 emission norms, which also resulted in price rise of vehicles by 10-15%.

Ashim Sharma, Partner & Group Head, NRI Consulting & Solutions said, “If you look at the previous fiscal, before COVID-19 there had been de-growth or sales had flattened out because of a structural slowdown. COVID made things worse last fiscal.”

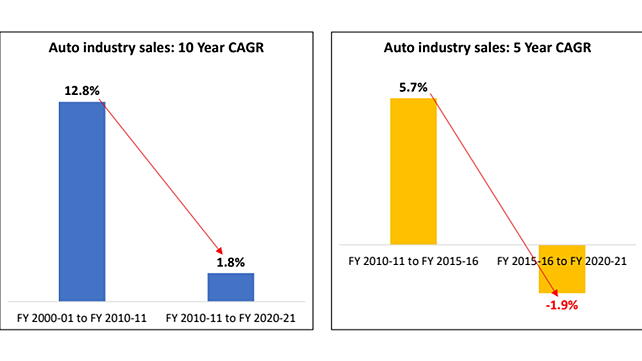

In fact, analysing the CAGR of the industry in the past decade reveals a dismal picture. Between FY16 and FY21, the industry CAGR fell to -1.9%, as against the previous five-year period, when the industry clocked a CAGR of 5.7% between FY11 and FY16.

When we compare the ten year data, the picture is scarier. Many experts believe that it is a combination of multiple things that has led to slow down the wheels of the auto industry.

Passenger Vehicles: Rise In UV Sales Negate The Effects Of COVID-19

As compared to other segments, the passenger vehicles segment has done fairly well. Sales of passenger vehicles, consisting of cars, UVs and vans, were only 2.2% less in FY21 when compared to FY20.

UVs, in fact, recorded a 12.2% growth to close at 1,060,750 units in FY21 against 945,959 units it accounted for in the previous year. This is the first time that UVs touched one million units in sales, largely driven by new model launches and a rise in disposable income of the upper-middle class.

| Passenger Vehicles (PVs)* | FY20 | FY21 | % Change |

| Passenger Cars | 16,95,436 | 15,41,866 | -9 |

| Utility Vehicles(UVs) | 9,45,959 | 10,60,750 | 12 |

| Vans | 1,32,124 | 1,08,841 | -18 |

| Total Passenger Vehicles (PVs) | 27,73,519 | 27,11,457 | -2 |

Despite increased demand for personal mobility, car sales dipped by 9.06% to 1,541,866 units and van sales fell 17.62% to close FY21 at 108,841 units. One of the primary reasons for the dip in van sales can be ascribed to people refraining from shared mobility during the pandemic, and schools being shut. Schools are the largest consumer of the segment.

Giving credits to a stable rural economy, Shashank Srivastava, Executive Director, Marketing and Sales, Maruti Suzuki India said, “Recovery started with rural economy thanks to good monsoon, which led to a good harvest in both seasons of Rabi and Kharif. Moreover, the sentiment was less negative for COVID-19 in rural areas. Hence we saw a sharper recovery, and the year ended flat.”

He highlighted that there have been lots of best-ever sales months in FY21 that is largely because of pent-up demand. The pent-up demand thus created was fulfilled in the last nine months of FY21. “We saw about a 5% increase in first-time buyers but on the other side, there was a decline of 6-7% in replacement buyers,” he said.

Other factors that influenced passenger vehicles sales were vehicle price hikes and high fuel prices.

Commercial Vehicles: Going Through A Structural Slowdown

The commercial vehicle segment is undergoing a structural slowdown, which was long induced by a simple law of axle norms. It was severely impacted by rising fuel prices, lower freight rates and active cargo movement on Indian railways, which earlier used to happen on medium and heavy commercial vehicles.

| Commercial Vehicles (CVs) | FY20 | FY21 | % Change |

| M&HCVs | |||

| Passenger Carrier | 40,016 | 7,322 | -81.70 |

| Goods Carrier | 1,84,412 | 1,53,366 | -17 |

| Total M&HCVs | 2,24,428 | 1,60,688 | -28.40 |

| LCVs | |||

| Passenger Carrier | 45,814 | 12,088 | -74 |

| Goods Carrier | 4,47,351 | 3,95,783 | -12 |

| Total LCVs | 4,93,165 | 4,07,871 | -17.30 |

| Total Commercial Vehicles (CVs) | 7,17,593 | 5,68,559 | -21 |

Sachin Haritash, Director, Chetak Logistics said, “Apart from COVID-19 and lockdown, major impact on commercial vehicles is due to low freight rates, rise in fuel and tyre prices. These have hit the operational cost of transporters due to which they are not able to replace their trucks. Another reason is excess capacity, which rose after the implementation of axle norms.”

On other hand, light commercial vehicles are going through a tactical shift because of the electrification of the fleet. Also, an increase in the hub and spoke models has led to the growth of smaller commercial vehicles (SCVs), which are now largely electric.

The bus segment, on the other hand, was majorly impacted due to COVID-19, largely because of office and school shutdowns.

Two-Wheelers: Unemployment Blues Pushing The Segment Down

The Indian two-wheeler segment has been largely hit by the slowdown. Many middle-class families fear job losses, while some have already lost their jobs. These factors have resulted in the segment witnessing a steep decline in domestic sales.

According to Pew Research, financial woes brought by COVID-19 have pushed about 32 million Indians out of the middle class, undoing years of economic gains. This, coupled with high fuel prices, acted as a double whammy. It not only created havoc in the entry-level customer's mind but also kept them away from visiting showrooms.

| Two-Wheelers | FY20 | FY21 | % Change |

| Scooter/ Scooterettee | 55,65,684 | 44,79,848 | -20 |

| Motorcycle/Step-Throughs | 1,12,13,662 | 1,00,19,836 | -11 |

| Mopeds | 6,36,812 | 6,17,247 | -3 |

| Electric Two-Wheelers | 274 | 2,456 | 796 |

| Total Two-Wheelers | 1,74,16,432 | 1,51,19,387 | -13 |

However, the only silver lining in two-wheelers is the strong rural sales. Overall, motorcycles saw a decline of 11%, while scooter sales dropped 20% in FY21 as compared to the corresponding earlier fiscal.

“The fall in sales of two-wheelers and small cars clearly shows that the lower strata of the society have seen major job losses and pay cuts,” said Sharma.

One of the major shifts in the two-wheeler space is being seen among large e-commerce and ride hailing players, who are shifting to electric two-wheelers.

Three Wheelers: Free Falling sales

The three-wheeler segment saw the steepest decline of 66% in domestic sales, as people largely refrained from travelling in public transport. Moreover, sales in the cargo segment were largely hit by the rise of electric three-wheelers. New-age companies like Amazon, Flipkart and other e-commerce giants are opting for electric three-wheelers for last-mile connectivity.

| Three Wheelers | FY20 | FY21 | % change |

| Passenger Carrier | 5,25,532 | 1,34,087 | -74 |

| Goods Carrier | 1,11,533 | 82,110 | -26 |

| Total Three Wheelers | 6,37,065 | 2,16,197 | -66 |

“There is a bloodbath in the segment, as essential commuting has gone down dramatically. Also, most of these people bought three-wheelers on loans and due to lockdown major defaults happened due to which used vehicles came into the market,” said Sharma.

Outlook: Fear Of Second Wave And Supply Chain Disruptions

The recent rise in COVID-19 cases and subsequent restrictions announced by different State governments is slightly concerning for the automotive industry. For an industry that contributes about 35% of the overall value of the supply chain, supply-side shortages, including the global semiconductor crisis, is a growing concern.

Nikunj Sanghi, Director, JS Fourwheel said, “While FY21 was on better than expected lines considering the washout in the first few months, I am concerned about the next few months. This is the harvesting month and it is important for the revival of the two-wheeler segment. Looking at the Vahan data, I can sense there will be drop across all segments on a month-on-month basis, which hasn’t happened in the last few months.”

Industry experts said the government should increase vaccination as much as possible to control the current situation. The industry regained some of its momentum through a difficult FY21. Another forced lockdown, or lack of economic activities, will push back vehicle sales further, and that is not what the industry can afford at this juncture.

Data Source: SIAM